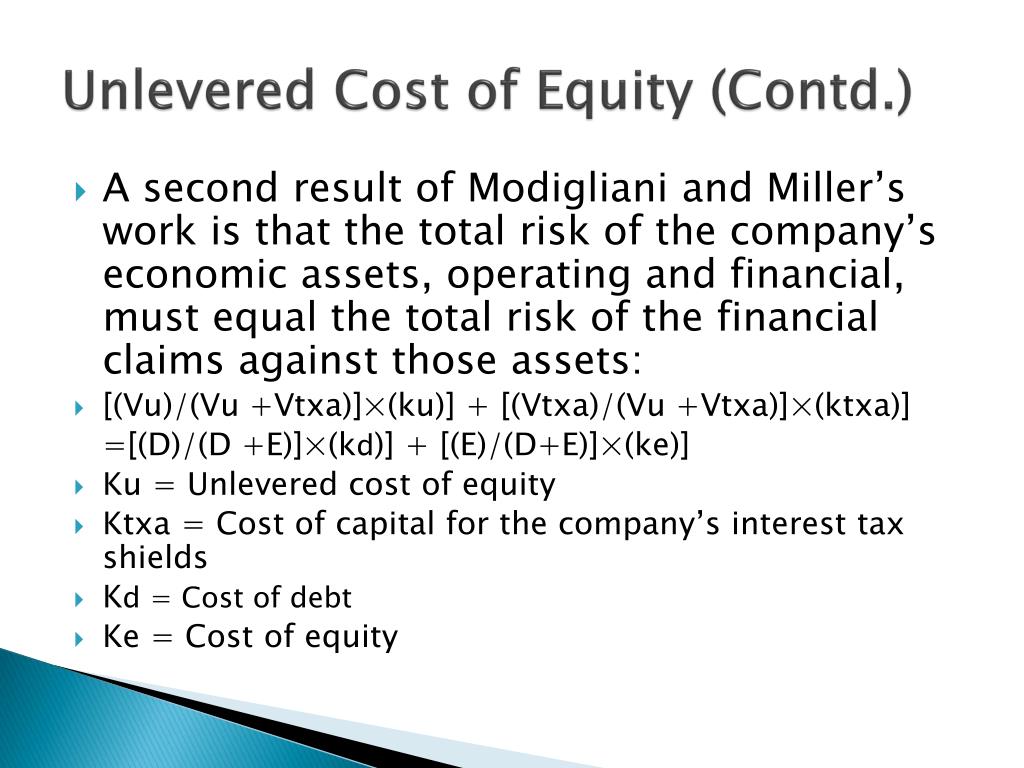

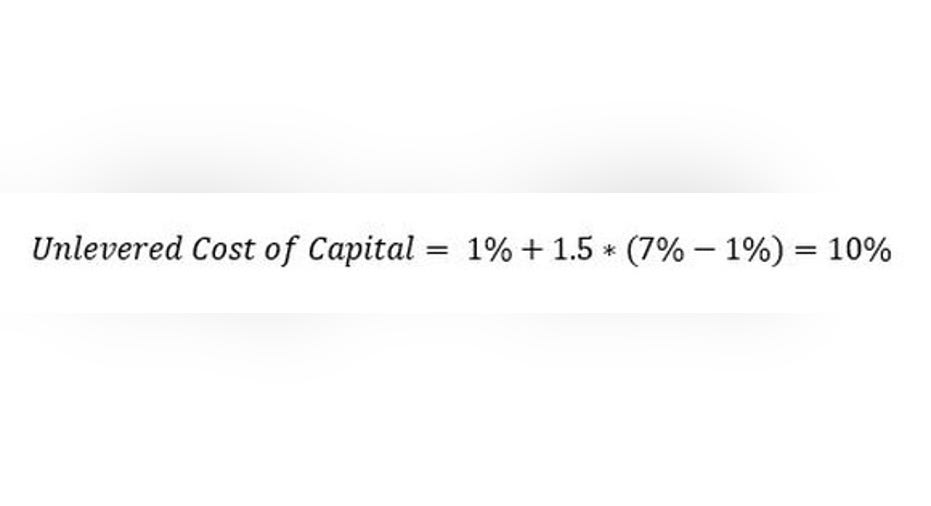

CAPITAL BUDGETING WITH LEVERAGE. Introduction Discuss three approaches to valuing a risky project that uses debt and equity financing. Initial Assumptions. - ppt download

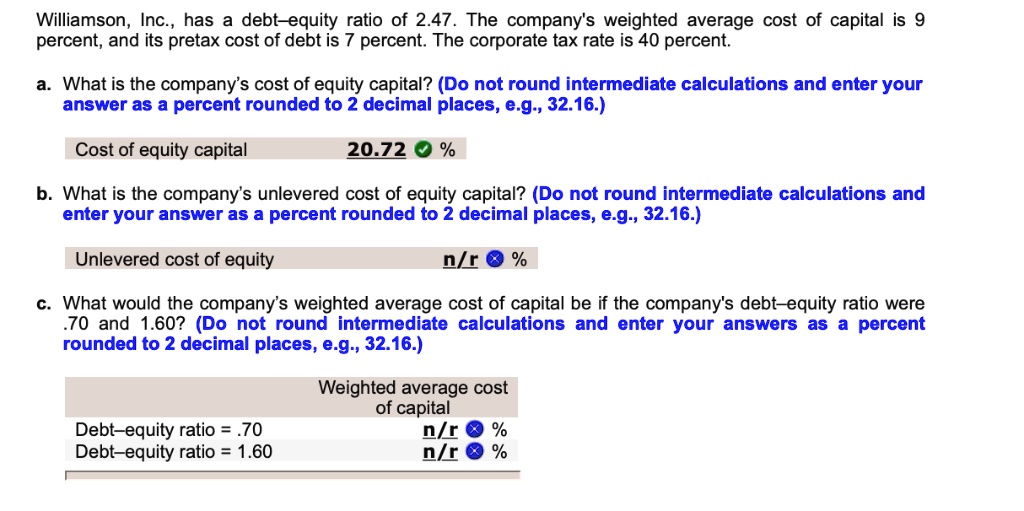

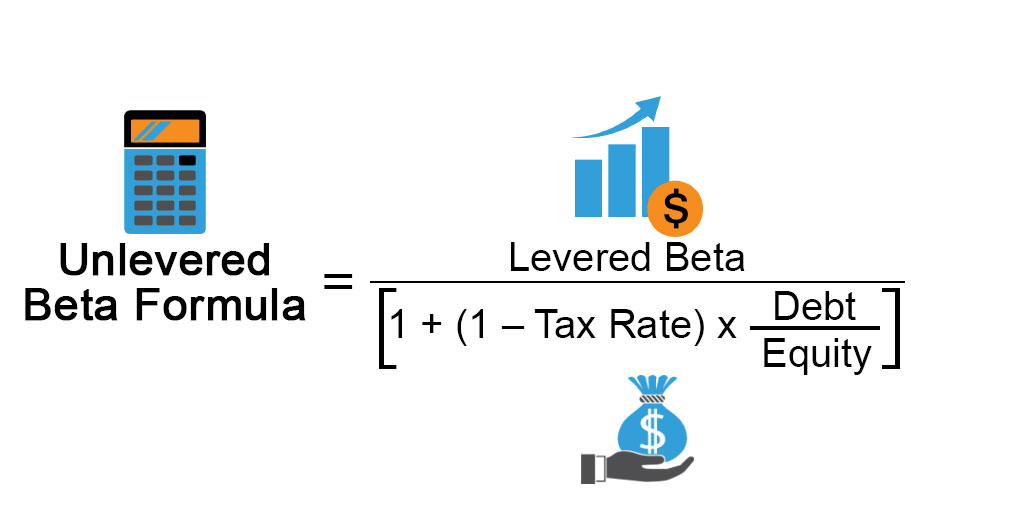

Weston Industries has a debt equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 7 percent. The corporate tax rate is 35 percent. i. What is